The challenges and opportunities of doing business with government

By Suroopa Chatterjee

In recent years B2G has been emerging as the new buzz word in the business landscape.

Businesses worldwide have undergone rapid transformation in the way they operate as they compete in an extremely challenging and dynamic environment. Procurement or buying procedures have become volatile and complex, particularly in the B2B, B2C and B2G segment.

Much like private companies, governments too must purchase materials and services for their operational requirements.

So, public procurement and outsourcing is a huge business that involves a government or state owned enterprise buying goods and services from private players.

B2G or Business-to-government (also sometimes called business-to-administration) is a business agreement to supply goods, services, and information between businesses and government at all levels (state, local and federal or central).

A big or small business that engages in service or goods supply to a government agency it’s a B2G transaction, irrespective of whether it involves billions of dollars in the defense sector or selling IT solutions for governmental administrative work. If providing sanitation personnel to a government institute or a small firm supplying office stationery to local or state agencies.

Then of course there is B2G e‑commerce, which is nothing more than using the internet in this procurement process as well as for licensing procedures and other operations related to commerce between companies and the public sector.

What are the opportunities for B2G, especially for SMEs? Many governments award lucrative contracts yearly to private players, clearly that means immense opportunities for both newbie startups and well-established private suppliers. And, most businesses see stable business in partnering with public companies and governmental entities. The volume and money involved is far more than in the private sector.

In addition, the governmental stamp offers some assurance to private suppliers as public procurements are governed by some specific rules and laws given that they utilize a sizable portion of taxpayer’s money. Tender processes make it free from discrimination. Of course navigating through these processes ensure that funds are utilized efficiently, legitimately and effectively with transparency that, ideally, involves very little waste of public resources.

The basics are different for government bodies when compared to private companies, because the former’s purpose is not to make a profit for its shareholders.

What are the opportunities for startups in India? In a country like India, government tenders offer a good pilot opportunity for startups that have had limited success in bagging private projects. Also, by giving startups this opportunity, governments open a wider spectrum of vendor choices as startups are more proactive than corporate vendors, often providing cheaper and more creative alternatives.

For businesses to thrive and grow, ultimately it is all about the customer. And, a vital part of sales strategy is to do business with the government.

Despite their advantages, startups do face challenges in trying to launch a smooth stream of business contracts as they must submit a previous track record of handling similar projects.

The selection criteria for public buyers to opt for a particular supplier vary from that of a private sector. Often, to be eligible for selection, suppliers must keep abreast of requirements in terms of prices, quality, ethical standards, and financial stability as these are vital criteria.

According to experts it’s always a better practice for suppliers to establish a firmer foothold with buyers before the actual tender is issued. This allows suppliers to understand the buyer and use innovation to highlight their edge over other competitors by providing more value than just products or services.

Which sectors offer the most opportunity in India? The central government, each of the 29 state level governments, and seven union territories are the largest purchasers of supplies and services. In India, a combination of central and state government tenders totaling around 75,000 are published monthly.

Government tenders account for around 10% of the GDP. Indian Railways, the CPWD (Central Public Works Department), MES, State level PWDs and PSUs like BPCL, HPCL, NTPC, to name a few, usually float tenders. The value of these can range from anywhere between INR 2 lakhs to a few thousand crores which makes it a huge business opportunity for SMEs.

Asides from seeking potential customers from consumers and industry, foreign companies also look to the government sector for optimizing their investment returns in India. Of course many foreign companies operating in India face issues of lack of transparency, absence of standardization, and an excess of red tape, which delays processes.

There have been a several initiatives from the government – namely Make in India, Skill India, Smart Cities, Urban Transformation, FDI reforms, EODB or Ease of Doing business reforms along with a strong push from the Ministry of railways, power, transport, aviation, food processing, and construction – that have created and will continue to build a huge market for large and small enterprises in India over the next two decades.

Recently awareness has focused on how urgent it is for state governments to improve their ease of doing business, as many across the world look to India as a future partner. Different states have implemented reforms to make the processes easy for business and speeding up clearances for pending projects. This has also generated enthusiasm within states themselves to invite more development investments.

Ever since systems went online with regards to opportunities and bidding, procurement processes have become more user-friendly and, to an extent, eliminated the challenges previously encountered offline. Also, government officials have updated their skills and are working professionally for a smoother execution.

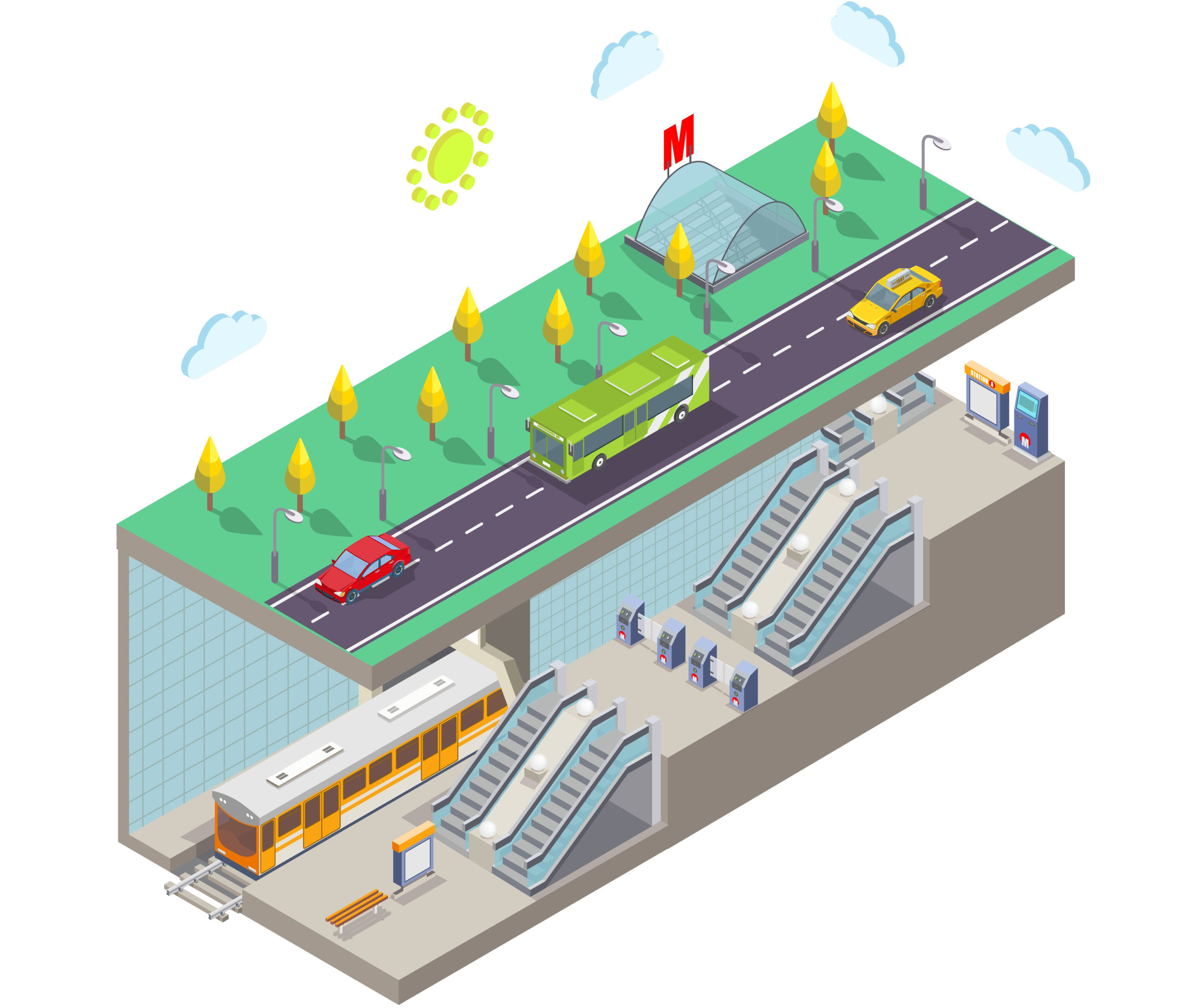

Construction and infrastructure companies are two sectors that have relied on contractual work with state and local governmental agencies.

Contractors are often consulted for new office buildings, landscape development, road repairs or construction. Agencies then seek requests for proposal (RFP), outlining work they require and the submission guidelines. Company owners submit bids that include an estimate of the cost and time required for completion. Then the L1, or lowest bidder, bags the project. But experience and quality sometimes take precedence in matters of selection.

Data is vital and handling it efficiently also offers a huge opportunity for companies whose core strength is Information Technology. From filing taxes, to managing sensitive records, government agencies handle a huge volume of data that requires swift and accurate information retrieval. Small companies can find opportunities by offering consultancy and software development services to government agencies.

GeM or Government e‑Marketplace, an online procurement platform, is the most widely used method for public procurement in India. MSMEs and startups, as well as small to medium companies can register as vendors and offer their services or products directly to government appointed personnel. GeM has launched GeM Startup Runway, an initiative allowing startups to reach out to government buyers by offering innovative items with unique process, design and functionality aspects.

In 2020, Tech Bharat held their first start-up conclave, Tech Bharat 2020, to connect and create a platform to build opportunities in private, manufacturing and government sectors. The conclave saw participation from the Government of India and the Government of Karnataka. With business development as their objective, the conclave intends to bring in national and business leaders as well as decision makers from large and mid-size enterprises. Tech Bharat wants to grow towards sustained growth by focusing on future technology adoption and vibrant ecosystems for innovation.